CDI ENTERS INTO FORCE BETWEEN PORTUGAL AND ANDORRA

The Agreement between the Principality of Andorra and the Republic of Portugal to avoid double taxation and prevention of fiscal evasion with respect to taxes on income (CDI) has entered into force, from 23 April- once ratified by two states for compliance with the internal procedures necessary. However, its implementation will not be effective until January 1, 2018.

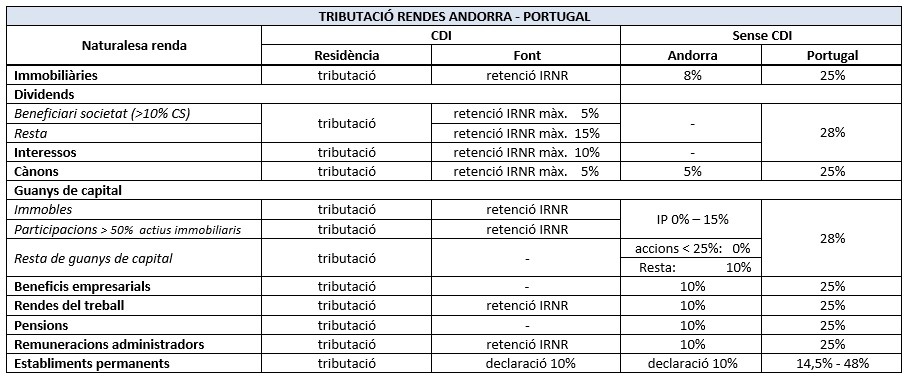

Depending on the type of income, will change the currently existing tax deductions regarding employers must practice Andorra to the income tax for non-residents (non-residents), as well as deductions for those who can bear operations in Portugal.

Thus, in general, income from the provision of services will be taxed only in the state of residence of the service provider, thus eliminating the requirement for non-residents to practice withholding by the payer of income.

With the application of CDI, will reduce the tax burden borne by individuals and companies resident in Andorra that generated tax revenues to Portugal and vice versa.

The table above sets out the main tax implications , depending on the type of income. However, however, taken into account the peculiarities that may occur each case. Contact IS21 team to analyze the situation and receive personalized advice.