The Government of Andorra has signed a Double Taxation Agreement – DTA with the Netherlands in October 2023 and is in the process of finalizing previous agreements with South Korea and Belgium. What implications do these agreements have for investors, residents and non-residents of Andorra?

Tax agreements

Tax agreements between Andorra and other countries

Tax agreements are an international tool used to promote transparency and fiscal collaboration in order to prevent tax evasion on an international scale. For some time, Andorra has been working on a legal framework that incentivises foreign investment, attracting talent and the economic diversification of the country.

The aims of these international agreements include the following:

- To maintain the idiosyncrasies and particularities of small countries due to their uniqueness and to ensure their survival in a global world

- To enter the EU, the European Central Bank and the IMF

- To ensure that there is no double taxation between countries for the same concept

- To come off the blacklist of tax havens

- To maintain current standards of living

Here at IS21, we have grown in parallel to the evolution of all the tax agreements between Andorra and other countries: Spain, Portugal, France, Switzerland, the OCDE ... and the following articles contained in our blog have echoed these developments:

The introduced amendment expands the list of states with which tax information relating to financial accounts from 2018 will be automatically exchanged in 2019.

The Andorran government presented on 16 June, the draft Law of automatic exchange of information on tax matters, fixing the exchange of data between Andorra and the 81 countries participating in the agreement.

On 23 December 2015 was published in the BOPA Agreement between the Principality of Andorra and the Duchy of Luxembourg to avoid double taxation with respect to taxes on income and prevent tax evasion.

The competitiveness of the economy of Andorra requires the internationalization of their businesses and opening up to foreign investment and improving the business structure.

On December 17, 2015 was issued the edict which was issued in the Official Gazette of the Principality of Andorra (hereinafter BOPA No. 88) Agreement between the Principality of Andorra and the Kingdom of Spain avoidance of double taxation with respect to taxes on income and prevent tax evasion. This, however, will come ...

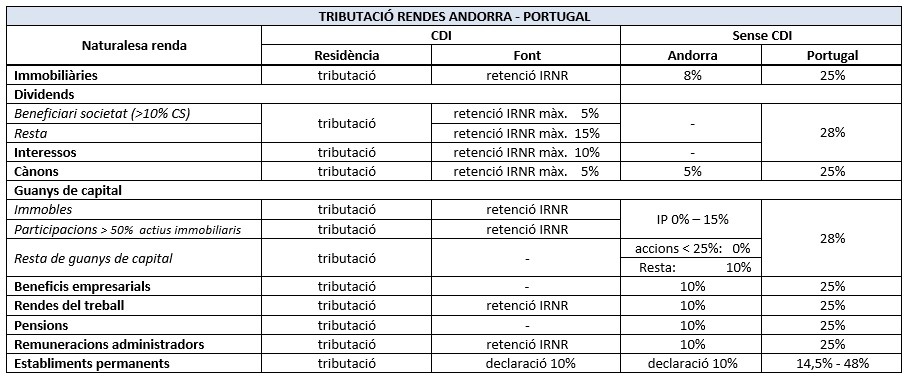

The Agreement between the Principality of Andorra and the Republic of Portugal to avoid double taxation and prevention of fiscal evasion with respect to taxes on income (CDI) has entered into force, from 23 April- once ratified by two states for compliance with the internal procedures necessary.

The Principality of Andorra has worked since 2009 at the opening of their economic and financial model based on transparency.

Andorra's Finance Minister, Jordi Cinca, signed the OECD Multilateral Convention to Prevent Base Erosion and Profit Shifting (BEPS). This new agreement marks a before and after in the history of tax agreements and offers greater security to companies, guaranteeing a better functioning of the international tax system.